Payment of salary reimbursements

Menu Path: Payroll >Expenses

Accessible to: Accountant

Accessible to: Accountant

Click on "Expense Advice" button on the top right of the page as shown below.

Vouchers which are pending for payment can be processed on this page, a row on the top of the page will show the number of vouchers and the amount which is pending for payment.

Step to follow:

- Click on "Create Advice" button

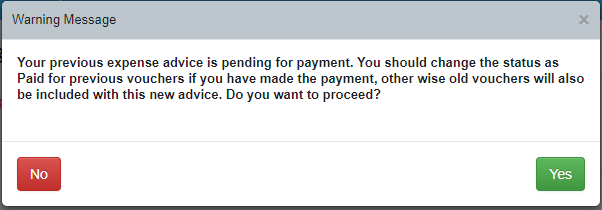

- If any advices have been are generated but not updated as paid then a

warning message will be appear as shown below. If you have already made

the payment of the previous vouchers then you should click on No and

then proceed to update the advices as paid else you can click on Yes

and proceed to generate the advices

3.You can "Download" the generated payment advices

4.If you have multiple companies then advices will be generated company

wise and advices will be created separately for each payment mode

5.When you click on "Confirm as Paid" then an alert will go to employees

informing him that his payroll reimbursement has been paid

Related Articles

Claiming salary reimbursements

Quick Access : Payroll > Payroll Claims Accessible to : All Employees Components of salary which are mapped to a reimbursement head can be claimed as salary reimbursement, submission of proper supporting documents might be needed for these claims. As ...Processing of salary reimbursements

Menu Path: Payroll Manager > Payroll Claims Accessible to: As per Setup You can 1. Approve submitted salary reimbursement vouchers - see below 2. Create salary reimbursement vouchers on behalf of employees - refer article 3. Process payments of these ...Creating salary for single employee

Creation of salary structure is one of the key steps. This article explains the process of generation of salary structure of a new joiner, one employee at a time. Refer to the article on Creating salary in bulk to review the process of creating ...Components of a Salary Structure

Employee's salary structure consists of multiple categories and within each category there can be multiple heads. Categories Explanation Monthly Taxable All the heads which are taxable are a part of this category – for example Basic, Special Pay ...Managing perquisite components of salary

Menu : Payroll > Employee Details > Employee - Payroll Details Accessible to : Payroll Manager Perquisites fall under Section 17(2) of Income tax act. EazeWork HRMS has the capability to manage the taxation of these perquisite heads as per India tax ...