Report - Statutory Bonus Payment Details

Reports > Payroll > Miscellaneous Reports

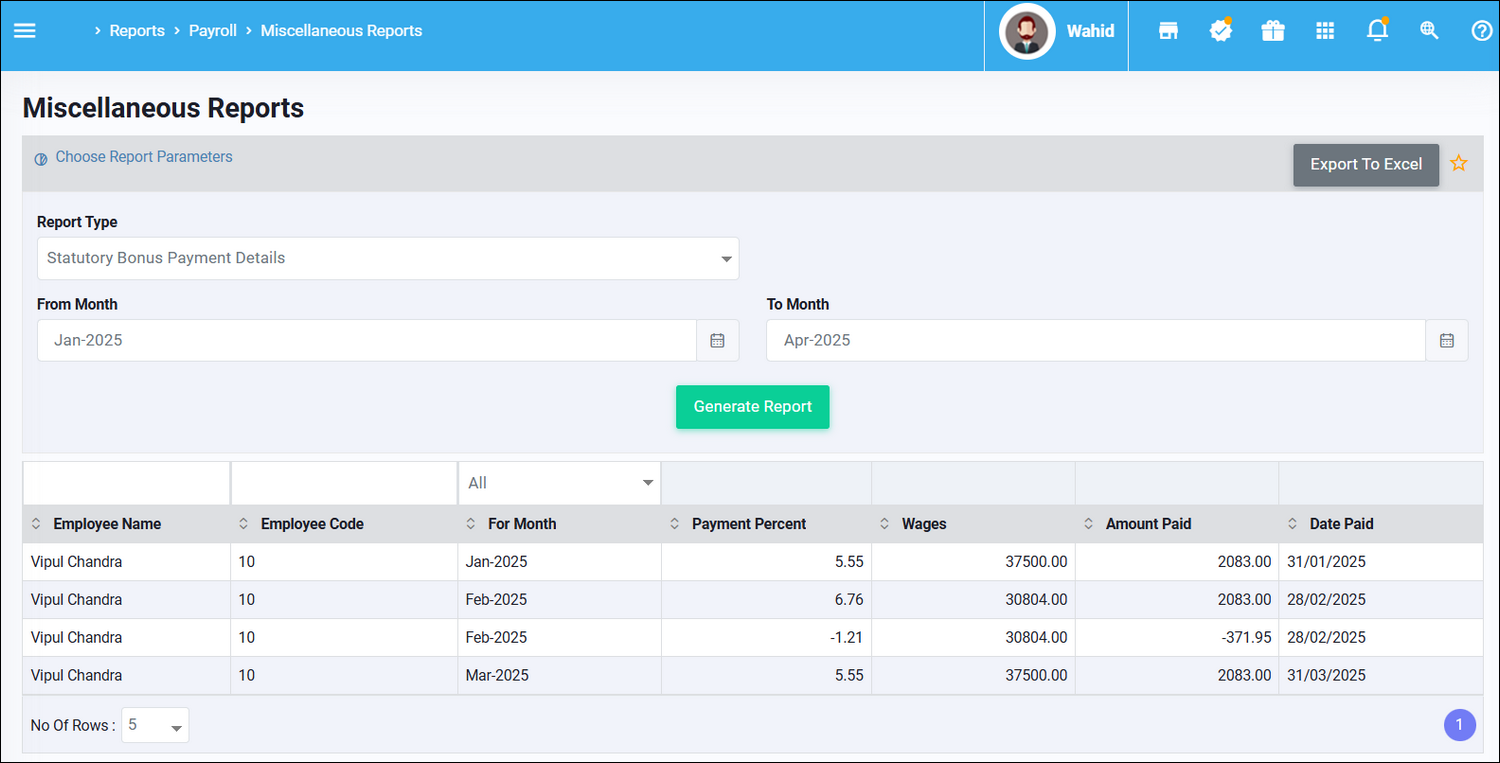

Through this report you can get details with respect to the amount of Statutory

Bonus paid.

In the Wages column the wages which are shown are based the Statutory Bonus eligibility calculation, it is on the basis of employee's actual wage, state specific minimum wages and the national ceiling of INR 7000.

Date paid column is the last date of the month of the month of payroll run. So

if you are running payroll of March on 3rd April and process Statutory Bonus

in it the date will be shown as 31-Mar as shown above.

Related Articles

Payment of Statutory Bonus

While performance bonus, retention bonus and various other types of adhoc bonuses can be paid to the employee there is one particular bonus which is mandated by the Government. This is governed by Payment of Bonus Act 1965 and its subsequent ...Report - Variable Performance Bonus Letter

Reports > Payroll > Employee Reports Through this report you can get the the bonus letter generated when bonus is paid through the system defined bonus head to employees. This bonus head is separate from the statutory bonus which is paid to employees ...Report - Statutory Bonus Provision

Menu Path: Reports > Payroll > Miscellaneous Report Through this report you can calculate the total provision you need to create for statutory bonus. Select From, To month and enter the percentage of bonus then by click "Generate Report" you can see ...Report - Emplyoyee - Head Wise

Reports > Payroll > Salary Reports From this report you can get details of salary paid to employees. Report can be generate active/resigned employees and regular/retainers separately. You can also select if you want to export all heads or a specific ...Report - Payroll Master Data

Reports > Payroll > Summary Report > Payroll Master Data Form this report you can download employees' payroll master data. Report can be generate for Active and Resigned employees separately and also for Regular / Retainers separately. For regular ...