Reports - TDS Payments Details

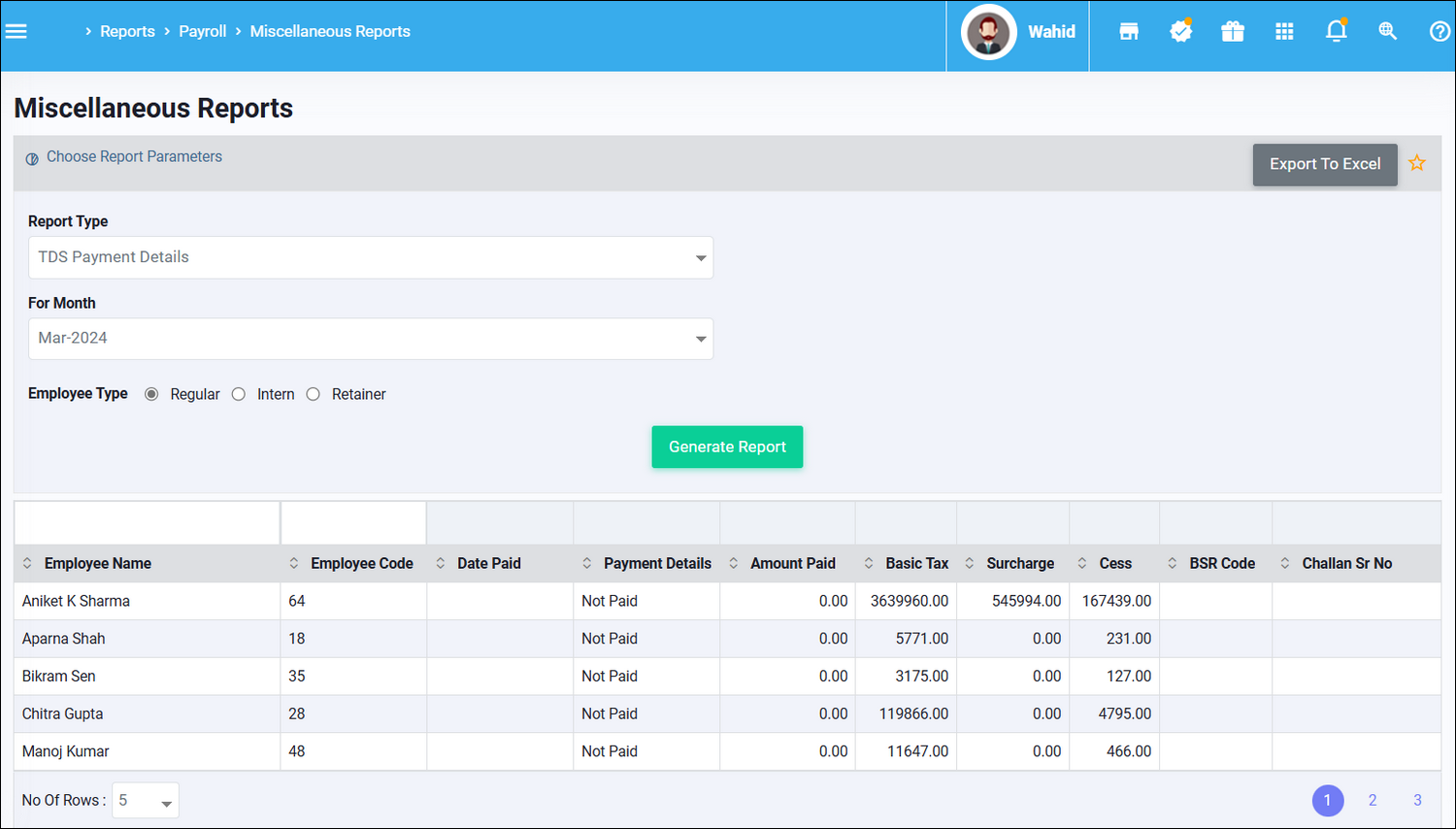

Reports > Payroll > Miscellaneous Reports

From this report the details of TDS payments made against the TDS liability for

an employee for a month can be downloaded. Data is available for Regular employees

and Retainers separately.

Click on "Export to Excel" to get output file in Excel format.

Related Articles

Reports - TDS Payment Advices

Reports > Payroll > Miscellaneous Reports From this report the details of TDS payments made against the TDS liability for a month for a TAN number can be downloaded. Data is available for Regular employees and Retainers separately. Click on "Export ...Reports - ITNS 281

Reports > Payroll > Generated advices ITNS 281 contains details of monthly tax liability with the breakup of TDS, Cess and Surcharge. This format is as per the Government requirement.Making payments to separated employees after Full and Final

Menu path : Quick Access > Payroll Manager > Post Separation Payments Accessible to : Payroll Manager If employee regular full and final has been paid and after full and final an amount like performance linked incentive or any other payment is to be ...Reports - PT Payments details

Reports > Payroll > Professional Tax This report is used to download payment details of payment made against Professional Tax deductions. Click on "Export to Excel" to get output in Excel format.TDS calculation methodology

While running monthly payroll or while doing the full and final for an employee EazeWork HRMS does the TDS calculations. The steps followed and specific scenarios which require additional explanation are explained below. 1. Base process The process ...